Services

Momentum for Health provides complete, personalized behavioral health care for adults in Santa Clara County. Discover our programs and services.

Community Programs

Stories of Recovery

News

We’re creating a new path forward for behavioral health in our community and beyond. Keep up with Momentum for Health’s latest news and events.

See All News-

April 3, 2024

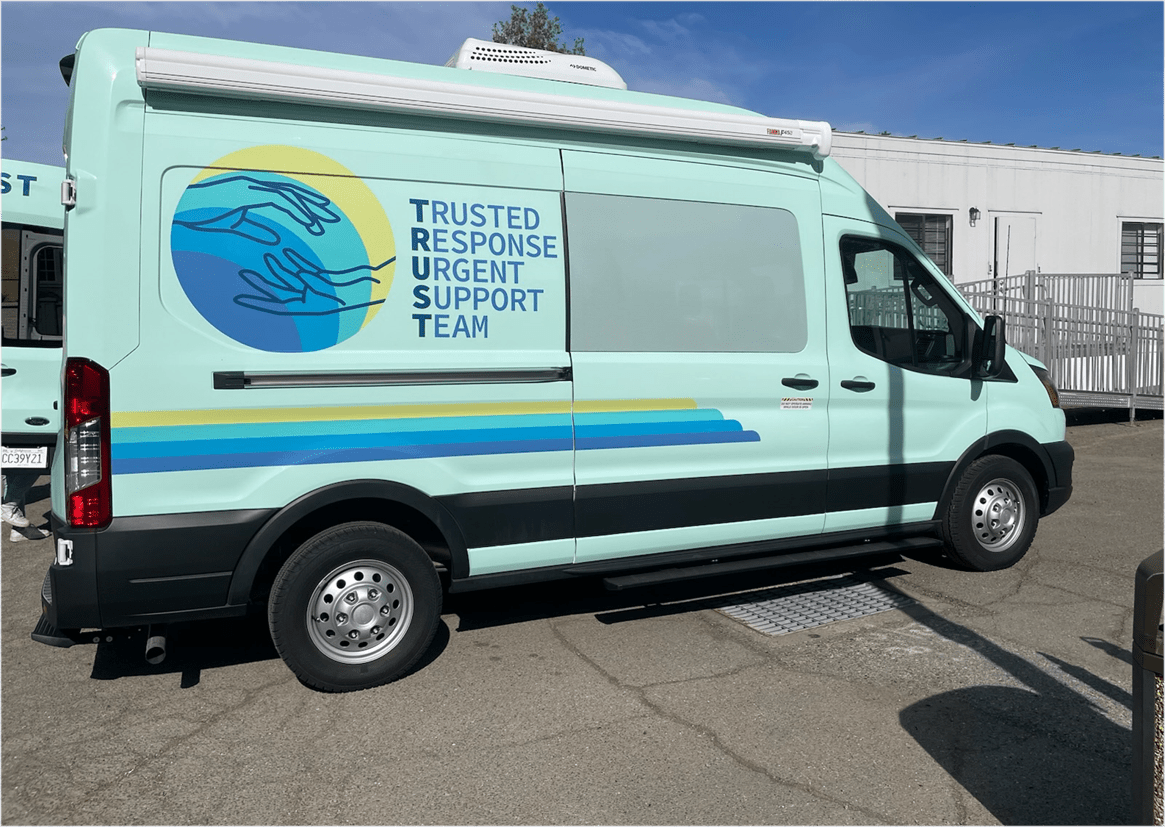

What is TRUST? How Does It Work?

Read More

-

March 28, 2024

Celebrating Women’s Voices for International Women’s History Month

Read More

-

March 25, 2024

Experts explain why it may be more difficult to find mental health professionals in Bay Area

Read More

-

March 24, 2024

‘We’re exhausted’: Bay Area mental health shortage deepens as need explodes

Read More

-

March 22, 2024

Mental health awareness: Palo Alto offers free training for residents

Read More

-

March 21, 2024

San Jose pushes to expand police alternative for mental health crises

Read More